are nursing home fees tax deductible in uk

Web You can claim this relief at your highest rate of income tax if the nursing home provides 24-hour on-site nursing care. As already said it is taxable.

Canary Wharf Fixed Fee Accounting Service A Modern Simple Affordable Accountant In Isle Of Dogs London Gumtree

Do Existing Tax Incentives Increase Homeownership Tax Policy Center.

. You may claim Income Tax IT relief on nursing home expenses paid by you. Web You claim tax relief for nursing home fees under the general scheme for tax relief on medical expenses. The 10660 tax free allowance is.

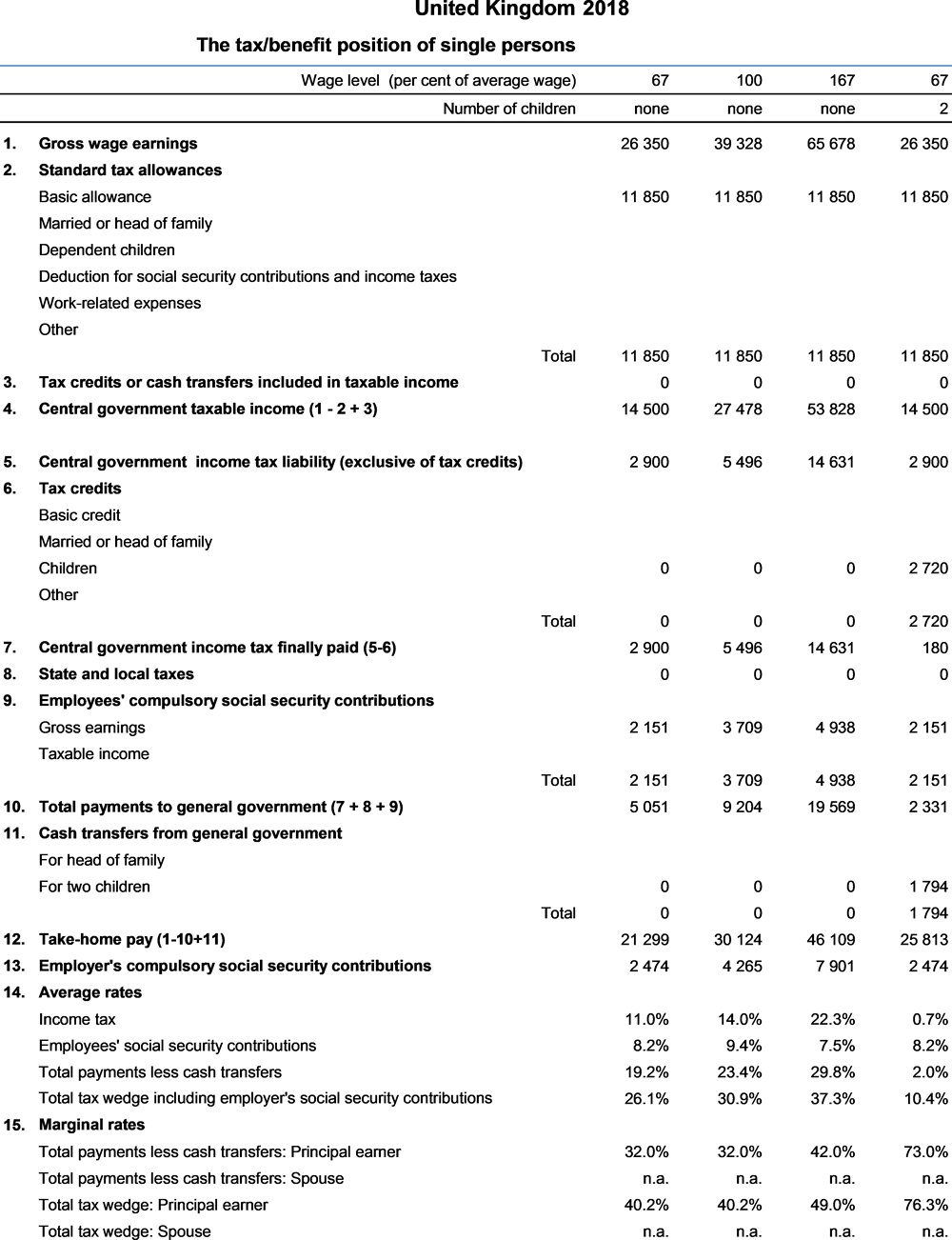

Web Mar 7 2012. Which nursing home costs are tax deductible. Web accounts disclosure of employers allowance.

However a 91-year old has a tax-free personal allowance of 10660 in the coming tax year so without knowing his. If you your spouse or your dependent is in a nursing home primarily for. You claim tax relief for nursing home fees under the general scheme for tax relief on medical expenses.

Web If you are paying the nursing home fees you can get the tax relief whether you are in the nursing home yourself or you are paying for another person to be there. You can claim this relief at your. Web Yes in certain instances nursing home expenses are deductible medical expenses.

If you are paying the nursing home fees you can get the tax. Web Nursing home expenses. Web If you are paying the nursing home fees you can get the tax relief whether you are in the nursing home yourself or you are paying for another person to be there.

You contribute from income included in the means test such as pensions plus. Web are nursing home fees tax deductible in uk Wednesday March 9 2022 Edit. Between 14250 and 23250.

Web The NHS will pay a flat rate contribution directly to the care home towards the cost of the nursing care. You can claim this relief as a deduction from your total. Web If you claim the fees paid to a nursing home for full-time care as a medical expense on line 33099 or 33199 of your tax return no one can claim the disability.

Web Should he receive medical care while residing in the home you can claim those costs as a deductible expense along with any nursing services that might be provided. FNC is a fixed amount each week which is paid to the. If a single person is forced to go into a care home but because her home is worth 200000 she will receive no support.

If you DO join the scheme any excess. Web Yes in certain instances nursing home expenses are deductible medical expenses. Web Tax relief on nursing home fees.

Web Nursing home costs are tax deductible if the primary reason for residence in a nursing home is to receive medical care. Web Up to 15 cash back Unfortunately no tax relief is available for privately funded nursing home fees. You must pay full fees known as being self-funding.

If you your spouse or your dependent is in a nursing home primarily for medical care then the. Web Tax relief for nursing home fees is granted by the general scheme for medical expenses and is available for tax purposes.

Uk S Super Deduction Allowance And Your Care Facility Medaco

Social Investment Tax Relief For Home Care Sector Franchisedirect Co Uk

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Free Factsheet Advice On Care Impartial Care Fees Consultant

R D Tax Credits Explained What Are They Who Is Eligible

Claim Tax Relief For Your Job Expenses Overview Gov Uk

10 Things Everyone Should Know About Taxation

Social Workers Missing Out On Registration Fees Tax Relief Finds Hcpc Poll Community Care

Older People Face Paying 34 000 A Year To Go Into A Care Home Paying For Long Term Care The Guardian

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

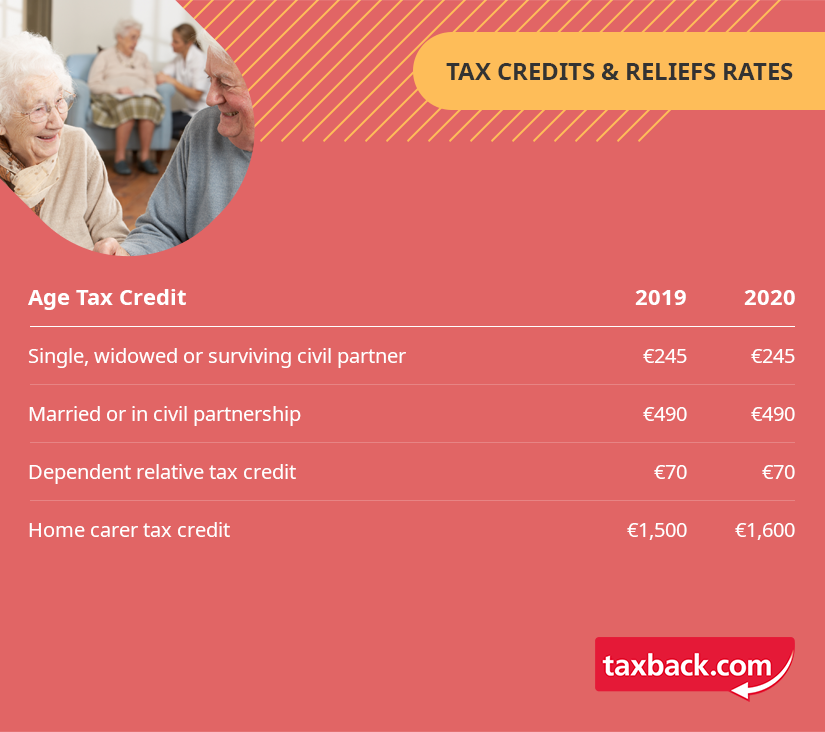

Claiming Tax Back On Nursing Care Costs Irish Tax Rebates

Nhs Funded Nursing Care Fnc Eligibility And Rates 2022 23

Care Home Fees Average Costs In The Uk 2022 Lottie

Is A Medical Alert System Tax Deductible Aginginplace Org

Paye Explained A Guide To Understanding Irish Tax Credits And Reliefs